Reporting Currency/ Base Currencymeans the currency used in presenting the financial statements which will be the Pakistani Rupee. At the request of offshore investor, the Fund reserves the right to also present the financial statements in foreign currencies. Here’s an example of the Russian Rouble falling past58 on July 21, 2022, against the USD. In this case, the USD is the base currency, and RUB is the counter currency. Usually, many countries use widely accepted currencies, like USD, EUR, etc., to denote the value of a base currency.

Bed and bath linen market size to grow by USD 39.28 billion from 2022 to 2027: Health-related benefits of linen products to boost market growth - Technavio - Yahoo Finance

Bed and bath linen market size to grow by USD 39.28 billion from 2022 to 2027: Health-related benefits of linen products to boost market growth - Technavio.

Posted: Thu, 02 Mar 2023 03:00:00 GMT [source]

From its inception in 1999 and as stipulated by the European Central Bank, the euro has first precedence as a base currency. Therefore, all currency pairs involving it should use it as their base, listed first. For example, the US dollar and euro exchange rate is identified as EUR/USD.

Contents

https://forexarena.net/ity is the ability to sell and buy something as quickly as possible. Some things are more liquid - can be easily bought or sold, while others are less liquid - it’s more difficult to sell/buy them. This is the British English definition of base currency.View American English definition of base currency. Definition and synonyms of base currency from the online English dictionary from Macmillan Education.

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. The abbreviations used for currencies are prescribed by the International Organization for Standardization .

In addition, IB-India accounts are required to maintain a Base Currency of INR. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. When you trade currencies, you go long the base currency and short the other. Local shifts in interest rates, trade deficits, and economic growth can all be reasons to favor one currency over another. If you buy the pair, you’re betting the base currency will go up relative to the quote.

Quote Currency

Nonetheless, when trading currencies, investors are selling one currency in order to buy another. Trades are done in “lots,” which are 100,000 units of the base currency. The U.S. dollar is frequently used as the base currency, since it is the dominant currency in the world economy, and so is most frequently used to pay for transactions. You'd better monitor several pairs and trading just one, for instance, by following the EUR/GBP when trading the GBP/USD. Although the GBP/USD is a more liquid currency than EUR/GBP, EUR/GBP is typically a good indicator for GBP strength.

Thus, the selling price of the currency pair is the amount one will receive in the quote currency for providing one unit of the base currency. This may seem like a large minimum investment , but currency trading can have margin factors as low as 2% depending on the currency pair. That means if you trade one lot with dollars as the base currency, you only need $2,000 in the account to control $100,000 in the trade.

Internet Security Policy

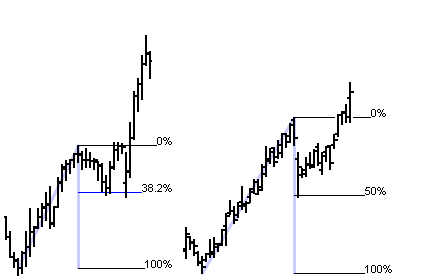

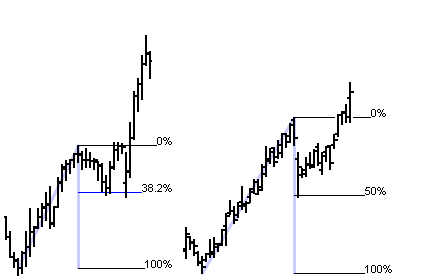

In Unit C, you will be familiarized with such fundamental and technical analytical resources. But before you start to interpret, there is a lot of information about price action that you can obtain simply through observation. Note that CHF has now become the base currency and its value is accrued in USD. The first member of every pair is known as the "base" currency, and the second member is called the "quote" or "counter" currency. The International Organization for Standardization decides which currency is the base and which one is the quote within each pair. Currency in circulation includes paper currency and coin held both by the public and in the vaults of depository institutions.

- And when someone says they want to buy a Forex pair, they want to buy the base currency using the quote currency.

- Start focusing on one or two pairs only, and don't overflow you with too much information.

- Further, economic parameters like government policies and international markets influence it.

- Foreign exchange markets are crucial for understanding both the functioning of the global economy as well as the performance of investment portfolios.

- While 60% of the volume of foreign exchange are made via London, the Sterling is not the most traded currency.

https://trading-market.org/ were then shifting capital away from Japan in order to earn higher yields. However, in times of financial crisis when risk tolerance increases, the Yen is not used to fund carry trades and is punished accordingly. When volatility surges to dangerous levels, investors try to mitigate risk and are expected to park their money in the least risky capital markets. CFDs are leveraged products that incur a high level of risk and a small adverse market movement may expose the client to lose the entire invested capital.

In this case all it takes is the trader to buy USD/SEK and to sell USD/NOK with equal position sizes. The position size depends on the pip value of the pair you are trading, as you will see later in this chapter. - It's a currency which can be bought and sold with ease at any time, because there is always a counterpart for the transaction. In other words, there are more buyers and sellers in a liquid market than in an illiquid one. The terms "thick" or "deep" are also commonly used to designate a high degree of liquidity.

By the same token, as crosses are created at the interbank level, you can create your crosses if they are not available with your preferred broker-dealer's platform. According to the last triennial survey from 2007 made by the Bank of International Settlements, this is the daily turnover in the Forex market per major pairs. This currency behaves similar to the AUD because New Zealand's economy is also trade oriented with much of its exports made up of commodities. Canada is commonly known as a resource based economy being a large producer and supplier of oil. The leading export market for Canada is by far the United States making its currency particularly sensitive to US consumption data and economical health. The Sterling is one of the four most liquid currencies in the Forex arena and one of the reasons is the mentioned highly developed capital market.

Exchange Rates

While 60% of the volume of foreign exchange are made via London, the Sterling is not the most traded currency. But the good reputation of the monetary policy of Great Britain and a high interest rate for a long time contributed to the popularity of this currency in the financial world. Spot exchange rates are for immediate settlement (typically, T + 2), while forward exchange rates are for settlement at agreed-upon future dates. Forward rates can be used to manage foreign exchange risk exposures or can be combined with spot transactions to create FX swaps.

The first https://forexaggregator.com/ is called the base currency and the second currency is called the quote currency. So for example, EURUSD, means that the base currency is the Euro and the quote currency is the USD. The quote currency is sometimes referred to as the counter currency. When buying a currency pair, investors purchase the base currency and sell the quoted currency.

- - It's a currency which can be bought and sold with ease at any time, because there is always a counterpart for the transaction.

- When you trade currencies, you go long the base currency and short the other.

- The counter currency is usually the foreign currency, and in the latter, it is the domestic currency.

- Currencies constituting a currency pair are sometimes separated with a slash character.

- This reading introduces the foreign exchange market, providing the basic concepts and terminology necessary to understand exchange rates as well as some of the basics of exchange rate economics.

And when someone mentions the price of the currency pair, it means the amount of the second currency necessary to buy the first one. In this case, the price of a EUR/JPY pair is the amount of yen needed to buy one euro. In every trading market, there is a certain type of asset that traders buy and sell and get payouts as a result. In stock trading, traders use company shares, in commodities, there are gold, silver, and other material assets. On the other hand, when the currency pair is sold, the investor sells the base currency and receives the quote currency.