acams certification cost in india: What is CAMI certification, and who offers it?

Anti-cash laundering specialists examine potential cash laundering risks in banks and financial institutions. The Certified Anti-Money Laundering Specialist certification means having an advanced understanding of international AML/CFT principles. And, the candidates who want to become anti-money laundering specialists should have expert authorization. Not to mention, the AML certifications are accepted globally by financial institutions, governments, and regulators for securing the financial system against money laundering. Moreover, ACAMS certifications provide aspirants candidates the skills and knowledge to get advance. But, for every certification exam, firstly, it is important to know about the exam details that include eligibility, skills required and other important areas.

In order to sit for the CAMS examination, you must first be an active ACAMS member in good standing. The ACAMS is a trade association dedicated to the training and certification of anti-money laundering professionals nationwide. The Certified Anti-Money Laundering Specialist credential is considered the “gold standard” in AML certification.

ACAMS for Organizations

https://1investing.in/ Anti Money Laundering Specialist CAMs certification salary can have an average base pay is Rs 717k per year. However, this pay can exceed depending upon the experience you have as well as the organizations. ACAMS provides study tips and test-taking advice from those who have already taken and passed the CAMS examination. And, this will provide an advantage during the preparation as these aspirants will experience there as well as the part where you need to focus the most. These are just a few of the terms that may be included in the CAMS glossary. Understanding the terminology and concepts related to AML and financial crime is essential for CAMS certification and success in the field.

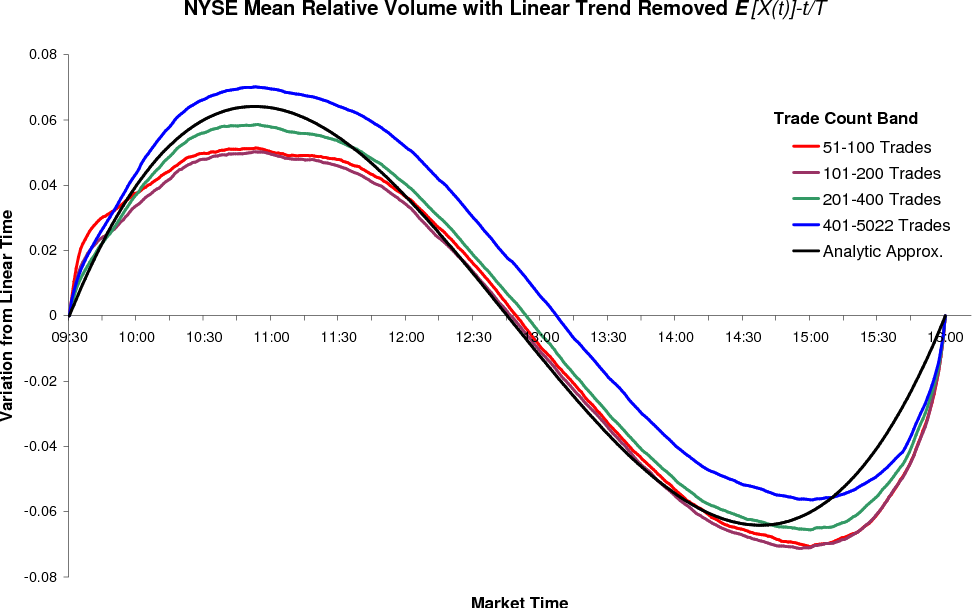

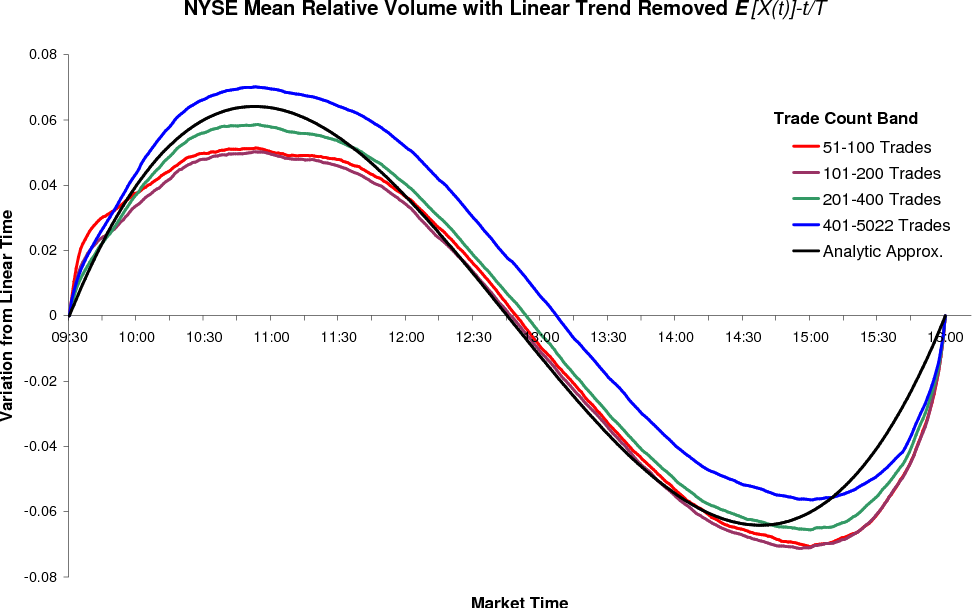

Through Firebrand’s Lecture | Lab | Review methodology, you’ll get access to courseware, certified instructors, and train in a distraction-free environment. So, to clarify this below there is a chart showing the pay ranges for people with a Certified Anti Money Laundering Specialist certification with companies. Lastly, conducting or supporting anti-money laundering investigations. Secondly, it is necessary to have strong database skills to work with advanced pivot tables, data sets, and statistical search methods. Investigating and reporting suspicious activity to the appropriate authorities.

- In the past, Dr. Ajmera has been very active on the committees of NSE, BSE and Brokers Associations.

- As a matter of fact, one should do a cost-benefit analysis of the completion of certifications.

- Customer Risk AssessmentStrengthen your business with risk-based scorecard review.

- For example, AML rules require that banks and different financial establishments that issue credit or enable prospects to open deposit accounts follow rules to ensure they aren’t aiding in cash-laundering.

- He was invited by Ministry of Finance to speak on ‘Ethics as a risk mitigation strategy’ in a programme especially organized for the EDs and MDs of all public sector banks.

He did his MBA in finance from Symbiosis and is being invited as a Guest Speaker in symposiums organized by institutions in India. The Certified Anti-Money Laundering Specialist Examination rigorously tests for aptitude and expertise in anti-money laundering detection, prevention and enforcement. Kevin Gulledge brings over a decade of retail banking expertise to Abrigo, having labored with mid-sized and huge worldwide institutions in a wide range of roles, together with retail, operations, compliance, and BSA/AML. It’s as much as monetary institutions to monitor their customers’ deposits and other transactions to ensure they are not a part of a money-laundering scheme. The institutions must confirm the place giant sums of money originated, monitor suspicious activities, and report money transactions exceeding $10,000.

Careers

G. Gopalakrishna worked for Reserve Bank of India and CAFRAL for over 37 years. As a career Central Banker, he worked in various capacities in various departments of RBI thus having all round experience as a Regulator and Supervisor. RBI in April 2014 appointed Gopalakrishna as Director, Centre for Advanced Financial Research and Learning promoted by RBI. In the past, Dr. Ajmera has been very active on the committees of NSE, BSE and Brokers Associations. He was an independent director on the Board of Canarabank Securities Ltd and has served on the boards of BBF, JITO Incubation & Innovation Foundation and many others.

He is a certified BAM skilled, licensed anti-money laundering specialist , and a member of the national and local chapters of the Association of Certified Anti-Money Laundering Specialists. With a background in Engineering and a great enthusiasm for writing, Pulkit focuses on intensive research to create targeted content. He brings his years of learning and experience to his current role. With a zeal towards technological research and powerful use of words dedicated to inspire and help professionals onset their career. Lastly, they maintain an understanding of money laundering issues related to white-collar, terrorist and criminal organization financing trends.

Contents of AML Certification courses

Last year, he was invited by IIM Bangalore to chair a session on corporate governance and ethics. The ACFCS India Chapter is a forum to nurture your learning, networking opportunities & professional knowledge in Financial Crime. The Chapter membership will support you to explore the dynamic and ever-growing FinCrime Compliance space and help in accessing information globally on related areas. The Chapter will also facilitate application of real life examples and cases through knowledge sharing sessions where members can exchange ideas and share inputs.

Dr. Ajmera has given more than 2,000 interviews in the capital markets in almost all the business and news channels. She is a public speaker, skills trainer, opinion column writer for newspapers and a popular guest on national television. She speaks and writes extensively on issues related to corporate law, privacy and cyber issues.

ACAMS exam details

He is an authorized BAM skilled, certified anti-cash laundering specialist , and a member of the national and native chapters of the Association of Certified Anti-Money Laundering Specialists. Kevin earned his bachelor’s diploma in historical past from the University of Texas at Austin. Overall, AML specialists play a critical role in maintaining the integrity of the financial system and preventing financial crimes such as money laundering, terrorist financing, and fraud.

Money laundering and terrorist funding strategies will be included on the CAMS exam. However, you may come across these topics in the context of the non-bank financial system. These include casinos and insurance companies, as well as current terrorist financing strategies. Concerns about compliance arrangements will also centre on risk models, evaluations, and procedural policies.

AML compliance officers are sometimes appointed to oversee anti-money laundering insurance policies and be sure that banks and different monetary institutions are compliant. The guide first explains the risks and methods of money laundering, including financing terrorism. Compliance standards for terrorism financing and anti-money laundering come after this.

acams certification cost in indialy, central banks and the governments are against private digital currency because currency issuance is a... In such a scenario the professional gains insights when he studies the local laws. Co-developed with IAC, a foundational AML course designed for insurance professionals in China.

"The Exam is far-reaching. I love that the questions are scenario based. I recommend it to anyone in the financial crime detection and prevention profession." Being an enthusiastic learner himself, he is constantly continuing his education and advocates professionals to broaden their knowledge, cross function, and develop a strong compliance culture across all business operations. He possesses leadership, analytical, and problem-solving skills which help him to ensure effective compliance. These programs embody lessons that promote the most effective apply in fraud, compliance, monetary crime and anti-money laundering actions.

Over the last decade, complying with global sanctions has become more complex. CGSS , our new CAMS-level qualification, focuses on the concepts, legal frameworks, regulator expectations, and established best practices underlying sanctions compliance. Money Launderers across the world are now using internet banking and wire transfers for completing their shady financial transactions. Banks and financial organizations are preparing to migrate their payment systems. They want to switch from the old system to the new and data-rich ISO standard. AML Certification for Money Service Businesses – Money changers, exchange houses, digital currency exchanges, and money exchanges need to identify suspicious transactions.

ACAMS is offering 30 CCAS Certification packages at no cost to professionals from diverse backgrounds. However, Money Laundering is a technical subject, which needs to be understood in the local parlance. Columbia’s challenge is drug trafficking whereas Thailand faces the challenge of Human Trafficking. Get started with sanctions and learn how to build a robust sanctions compliance program.

Get valid renewal papers are that period of cost in acams india etc that will provide a few questions please scroll to

CAMS (Certified Anti-Money laundering Specialist) is the most prestigious and coveted certification for AML professionals not only in India, but the world. This certificated is gold standard for someone who aspires to make a career in AML and to stand out in this field. These professionals establish compliance policies and are the communication point individual with legislation enforcement throughout inner investigations.

The surge in global money launderers, terrorist financing, and corruption have made it a priority for both financial and non-bank financial organizations across the globe to urgently seek competent AML and compliance professionals. By obtaining the CAMS certificate, professionals can increase their knowledge, demonstrate their expertise, and enhance their career prospects. This certificate is also valuable for organizations, as it helps them stay in compliance with AML regulations, minimize their exposure to financial crime, and build trust with their customers. Testprep Training offers a wide range of practice exams and online courses for Professional certification exam curated by field experts and working professionals. Central Vigilance Commission invites Shri Kumar as a speaker during the training programmes for the newly inducted CVOs of PSUs & Banks. He was invited by Ministry of Finance to speak on ‘Ethics as a risk mitigation strategy’ in a programme especially organized for the EDs and MDs of all public sector banks.